A while back we sat down with a prospective passive investor discussing an opportunity we were in the midst of raising capital for. He was excited about all the same things that excite us about investing in multifamily real estate.

The cashflow, the appreciation, the tax benefits, the control, the stability… he was psyched on all of it.

He went on to tell us that he loved investing in real estate so much that his portfolio was actually too heavily weighted in that sector and he was afraid of putting more money to work here. We were surprised to hear this because earlier in the conversation he’d made it clear he didn’t own any real estate and that he’d never passively invested in a syndication.

We probed a bit deeper and discovered that he actually had nothing invested in real estate. What he had was a misunderstanding and a whole lot of money in REITs.

One of the most common questions (and it’s one I wondered about, too, when I first started investing) is: What’s the difference between a REIT and a syndication?

As it turns out, there aren’t a ton of differences between a REIT and a Syndication, but the differences that do exist are quite substantial.

That’s not to say one is better than the other (though obviously we’re biased towards syndications). Our goal in this article is to outline the major differences between these two investment vehicles so you can better understand how they fit into your portfolio.

What is a REIT?

REIT stands for Real Estate Investment Trust and it’s a company that owns and operates income-generating real estate. These companies tend to be quite large and they focus within a particular asset class (industrial, multifamily, retail, office).

Funding a REIT is modeled after mutual funds where a group of investors pool capital. So far, this doesn’t sound terribly different than a syndication, huh?

An obvious difference is that REITs are traded on the public market in the same way as the stock market. You can open an account at Vanguard and buy into a REIT for only a couple hundred dollars.

REITs are easy to buy and sell which creates inherent volatility. If it’s easy for you to get in and out of a REIT, it’s easy for everybody else to do the same.

That’s one obvious difference between a REIT and a Syndication. Let’s talk about a few others.

Here are the 4 differences between a REIT and an Apartment Syndication

Ownership

The first thing to note is that when you invest in a REIT, you’re not actually investing in real estate. You’re investing in a share of a company that owns and operates real estate. This is a subtle, but important, distinction (especially when it comes to the tax treatment of these vehicles).

Contrast this with investing in an apartment syndication whereby you and a group of investors each invest in an LLC which in turn owns the real estate. As a result, direct ownership.

Here’s another aspect to consider. When buying into REITs, you don’t get a say in which properties are acquired. In fact, in many cases, it might be difficult to determine which buildings you’ve actually invested in. Your investment in these vehicles goes into what’s known as a blind pool that the operators disburse at their discretion.

Some apartment syndications are structured in a similar way, but most are what we refer to as single asset acquisitions. When presented with one of these deals you are looking at only one property (or a portfolio of properties grouped together) and you get to underwrite and vet those properties on the individual level. If you don’t like the location, business model, projected returns, or whatever, then you can opt out.

Not so with a REIT.

Liquidity

One of the strengths of a REIT is how easily you can buy and sell your shares.

Then again, one of the weaknesses of a REIT is also how easily you can buy and sell your shares.

Why is this both a strength and weakness?

Well it’s obviously great for you if need quick access to your capital. If you need to free up some capital, no problem, just grab your phone and pop open your Vanguard app. You’ll be liquid within a couple minutes.

Also, because REITs are publicly traded in the same way as stocks, it’s incredibly easy to hop into this investment vehicle without having to plonk down tens of thousands of dollars.

So far these only sound like good things, right?

Not entirely. The sword cuts both ways, unfortunately. Because it’s easy for you to buy and sell, it’s also easy for everybody else to buy and sell. This means REITs are prone to the same volatility as the stock market as a late-breaking news article or gang of Redditors can tank the value of your holding for no discernibly good underlying business reason.

Let’s contrast that with apartment syndications.

First, syndications are notoriously difficult to get into. You either have to be an accredited investor (in which case you have access to a smorgasbord of potential private placements), or, if you’re not part of the 10% of the population qualifying as an accredited investor, then you must establish a substantive preexisting relationship with an operator before you’re allowed to hop into one of their deals.

Second, regardless of which class of investor you fall into, apartment syndications aren’t something you can generally just jump into on a whim. Also, they’re notoriously illiquid investments running on average between 5-7 years. Oh yeah, and let’s not forget that the minimum investment amount is usually around $50,000. That’s a high hurdle for many people (though most people are surprised to find they actually have potential capital hiding in plain site. Read this article to learn more!).

In exchange for the lack of convenience, apartment syndications are notoriously secure investments that do not see wild valuation swings over night.

Which do you value more? Liquidity or Stability?

How you answer that question will go a long ways towards determining which of these investment vehicles is right for you.

Tax Benefits

“It’s not about what you make, it’s about what you keep.”

Your largest bill each year is likely to Uncle Sam. Nobody gets excited to pay taxes, but most people find the process to be so frustrating, obtuse, and demoralizing that they simply put it at the back of their mind until April 15th rolls around each year.

This head in the sand method of wealth management won’t do. Thankfully, there are some simple and easily accessible ways to reduce your taxable liabilities.

The most notable of which is by owning real estate.

There’s a reason 80% of millionaires own investment real estate. Sure, the returns are great, but generally speaking, it’s because the tax benefits are second-to-none.

Passive investors in an apartment syndication benefit from depreciation. Depreciation, in the simplest terms, is the way the IRS recognizes that everything in this universe has a finite lifespan. This includes our buildings and everything comprising them.

As a result of our buildings and everything inside of them wearing down with age and use, our buildings theoretically lose value. I say theoretically because in actuality, real estate is an appreciating asset. That is, it tends to get more valuable over time.

Okay, let’s put aside the paradox of an asset that simultaneously appreciates and depreciates for now and focus on what these tax benefits mean to you, the investor.

Depreciation passes through to your K1 (the tax return form you receive each year documenting how an investment performed) in the form of losses. These losses reduce your taxable liabilities on passively earned income which, for our purposes here in an apartment syndication, would be the cashflow distributions.

So, if you invested in an apartment syndication, then at the end of the year it’s likely you’ll have earned some cashflow distributions. This very real income which hit your bank account will most likely be entirely offset by your share of the deprecation write-off.

The result? You pay nothing on the cashflow distributions until you sell the property and the depreciation is recaptured. In the meantime, that’s tax-free income, baby.

Let’s compare that to the tax treatment you’ll receive investing in a REIT.

First, REITs do benefit from the power of depreciation, but this all occurs before the money ever hits your bank account. Sorry, you don’t get the personal benefits of depreciation in a REIT.

Second, REITs pay out dividends which are taxed as ordinary income. Depending on what tax bracket you’re in, that can be a sizable chunk of change.

In short, not only do REITs NOT reduce your tax burden, they actually make it worse.

These taxes really take a bite out of what would otherwise be considered pretty good returns.

Speaking of returns… let’s tackle that next because the amount you stand to make investing in a REIT versus an apartment syndication are pretty darn different.

Returns

Obviously returns vary by myriad factors, so let’s take this section with a grain of salt. We’re talking high level averages here.

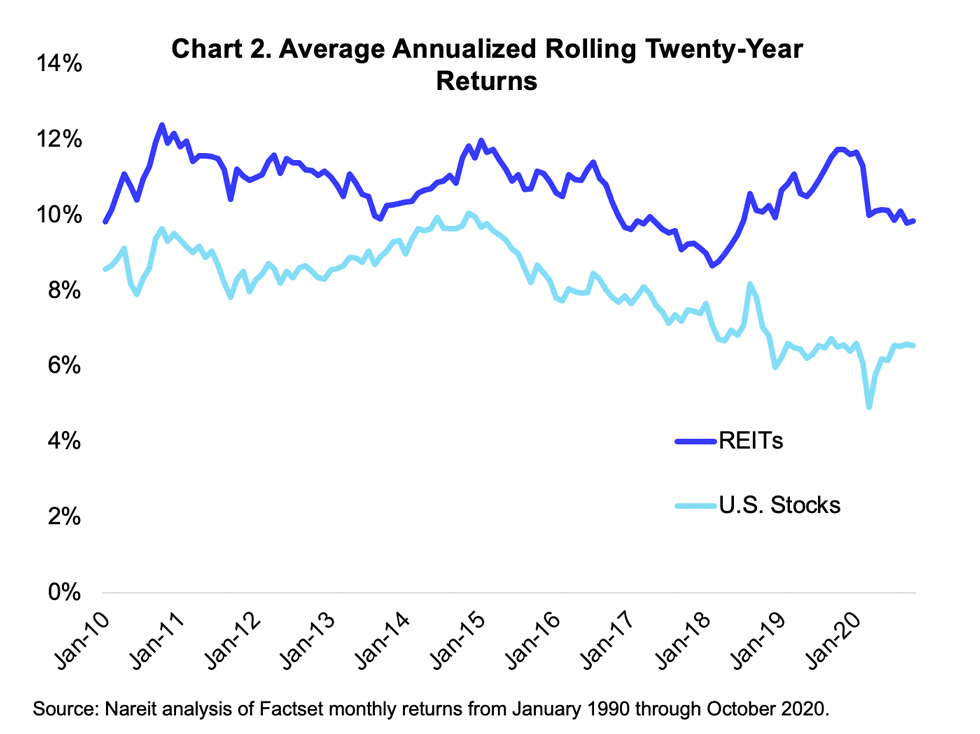

Historical data over the past twenty years shows REITs have outperformed the stock market, with an average annualized return of just under 12%.

That’s not a terrible return, especially when compared against the stock market. It’s important to note that these returns don’t factor in tax treatment (as that’s entirely variable depending on the individual). If taxes were factored into the returns, then the effective return of REITs would likely be around 8-9%.

Again, not terrible, but also not something you’re likely to get too excited by, either.

Apartment syndications by comparison often generate well north of 20 percent average annual returns after cashflow, refinances, and sales are factored in. It’s not uncommon to double your money in five years in an apartment syndication. A REIT, on the other hand, would likely take closer to 8 years.

And once more, because it’s so important and bares repeating, this doesn’t take into consideration the tax benefits associated with owning actual real estate like you do in a syndication.

Okay, that horse is dead. We’ll stop beating it now.

Should You Invest In A REIT or an Apartment Syndication?

As with most things in life, there is no one size fits all solution. Which investment vehicle is right for you ultimately depends on your unique goals and context.

If you’re just starting your investing journey and only have a little capital to invest, a REIT might be your best option until you have saved enough to meet the $50,000 minimum investment most syndications require. A REIT might also be the right choice for you if you foresee needing your capital in the near future. Syndications are illiquid vehicles and your money will be tied up for between 3-7 years in most cases. If you think you’re going to need that money next year for your daughter’s graduation, then a REIT again might be the right choice.

For us, syndications are our preferred choice of investment vehicle. I know, that’s not terribly surprising. We’re biased after-all, but for good reason. Once you factor in the tax benefits, better returns, and more security that comes from knowing the specific asset and the operating team, it’s a no-brainer for us.

Let’s finish this discussion of REITs versus Apartment Syndications by recalling the fact that life isn’t binary and that there’s nothing stopping you from diversifying into both investment vehicles. As the Buddhists would say, “the middle way is the way”.